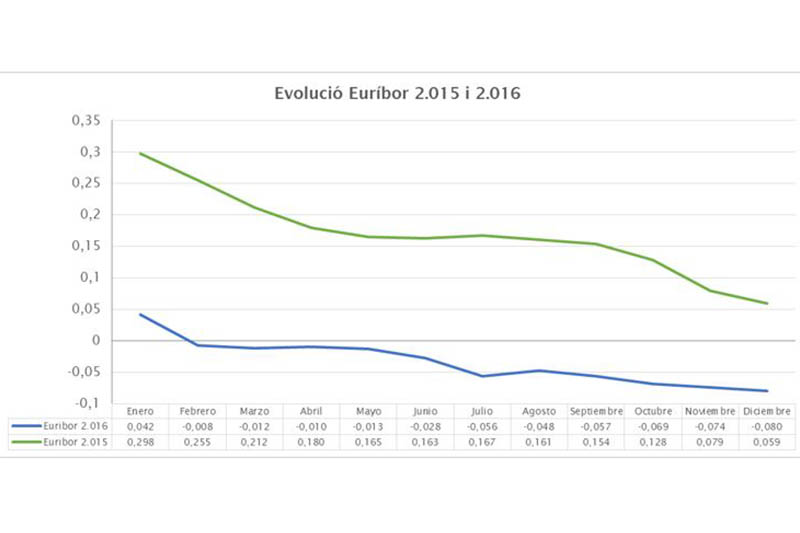

The twelve-month Euribor, the rate to which most variable mortgages in Spain are tied, is in negative numbers once again at the end of December, at approximately

-0.080%. This rate has fallen for 11 months in a row and is now at an all-time low since its creation in 1999.

This new Euribor rate is 0.139 points below that of the previous December (0.059%), which means customers will now pay roughly €75 less per year on mortgages signed last year.

Although the average interest rate for 2016 was negative, banks will never owe their clients money for their mortgages, as each loan applies a differential on top of the corresponding Euribor rate.

This rate, which began falling in May 2014, first posted negative values in February 2016, at -0.008%. Eight years ago, in July 2008, the Euribor hit its all-time high at 5.393%. The lowest rate to date is that of this December.

Analysts believe this downward trend will continue for several more months, as the European Central Bank (ECB) has kept the price of money at 0% since last March and expects to do so throughout 2017.

The counterpoint to these falling variable interest rates can be seen in fixed-rate mortgages, which are becoming a popular alternative for those purchasing a home. According to data from the Spanish National Statistics Institute, 10% of new mortgages were fixed rate in January 2016, while this figure had increased to 30% by September.

With these loans, banks guarantee APR rates between 2.5% and 4%, depending on the length of the mortgage. The lowest rates mainly apply to short-term loans (between 10 and 15 years) and go up as the mortgages get longer, to 25 or 30 years.

The main characteristic of a fixed-interest mortgage is that the monthly payment stays the same for the duration of the loan. The debtor, therefore, always knows exactly how much they will pay each month, unlike variable-rate mortgages, which change depending on the fluctuations of the rate to which they are tied, in most cases the Euribor.

Nevertheless, it is very important to go over all the conditions and commissions associated with this type of loans to avoid any surprises. In some cases, these contracts include opening commissions, fees for partial or total early pay-off or risk-compensation clauses that could be up to 5%.

In these cases, these are tools the bank uses to compensate for the losses it would incur through early repayment of the loan. Plus, the creditor protects itself against any possible drop in interest rates and establishes a powerful client-loyalty mechanism.

Experts stress, however, that there is no perfect mortgage. Each buyer must weigh up the options available and choose the one that best fits their personal and financial circumstances.