Barcelona, February 20 2018.- The purchase of a home is one of the most important economic decisions we make during our lives and for this reason it is very important to know all the factors that intervene in the process.

The location and the surface area are some of the elements that determine the search.

First we must analyze how much we are willing to invest in the purchase of a home and if we require financing. If financing is needed, we must have available a minimum of 20% of the purchase price. Having a certain margin for the legal expenses and extraordinary costs that might arise is also recommended. In addition, if we take out a mortgage loan, the experts recommend that the monthly mortgage payment should not exceed 35% of our family monthly income.

With the budget defined, we are ready to search for our new home. Having reached this point, the help and advice of a specialized consultant will make the entire search process easier, guiding us at every moment on the steps to follow.

HOW DO I FORMALIZE MY PURCHASE OPTION?

Once we have found the dwelling, it is time to formalize the purchase. First, however, it is essential to have checked the physical, urban planning and registry condition of the property that we are going to acquire.

Once the acquisition of the dwelling is clear, we must formalize the purchase:

- Reserve or make a down payment.

In case of requiring financing, it is usual for the buyer, when reserving, to want to condition the purchase on the granting of the loan, so that in case it is not granted, he may recover the amount delivered. - Earnest money contract

- Deed of Sale

TYPES OF CONTRACTS IN A PURCHASE AND SALE PROCESS

Article 1445 of the Spanish Civil Code, defines that “pursuant to the contract of sale and purchase, one of the contracting parties undertakes to deliver a specific thing and the other to pay a certain price for it, in money or something which represents it.”

In the case of the contract of sale and purchase of real estate property, it deals with a bilateral contract, for valuable consideration, which shall always include the following information: the parties thereof (buyer and seller), the object (real estate property), the purchase price, the payment method and the date of the deed.

Normally, prior or simultaneous to the sale and purchase, an earnest money contract will be formalized. The most common earnest money contracts are the double-rate cancellation penalties, pursuant to which you may rescind the purchase and sale with certain consequences for the parties, as indicated in Article 1454 of the Civil Code: “If earnest money or a deposit has been provided in a contract of sale and purchase, the contract may be rescinded by the buyer by agreeing to forfeit the earnest money or deposit, or the seller to return it in duplicate.”

The earnest money contract can be formalized in an independent contract or be part of the sale and purchase contract. The usual practice is that it is for 10% of the purchase price, although the economic conditions that are deemed advisable can be agreed between the buyer and the seller, indicating in the document the maximum period to execute the deed (normally it is stipulated in a maximum period of three months from the signing of the earnest money contract).

WHAT DOCUMENTATION MUST WE TAKE INTO ACCOUNT?

In order to be able to draw up and formalize a purchase and sale contract, the following documentation will be necessary:

- • Of the dwelling:

- Certificate of habitability (for new as well as second-hand dwellings).

- Energy performance certificate (CEE).

- Certificate of being up to date with the community expenses.

- List of the supply companies.

- Second-hand dwellings: last receipt of the Property Tax (IBI) that verifies that it is up to date in the payments

.

- Of the seller:

- DNI in case of natural persons or CIF and Public Instruments in case of companies.

- Property deeds or extract from the property registry that accredits the ownership of the property.

- Documentation related to the constituted mortgage, if applicable.

- • Of the buyer:

- DNI in the case of natural persons or CIF and Public Instruments in case of companies.

- Documentation related to the constituted mortgage, if applicable.

WHO HAS TO PAY WHAT?

For both the sellers and the buyers, it is very important to know the obligations, payments and expenses that may correspond to each of the parties.

Unless otherwise indicated in the corresponding contract, it shall be the responsibility of the seller to make the following payments:

- Those derived from a mortgage loan to finance the construction in the case of new construction.

- Those attributable to the public instrument of new construction and of horizontal division of the property of new construction.

- The tax on the increase in value of the land or the capital gains tax (“plusvalía”), in all cases.

- Those derived from the intervention of a real estate agent, in all cases.

- Those of connection of the accesses to the general supplies.

- Those derived from obtaining the documents that he must deliver to the buyer (CEE, Certificate of Habitability, etc.)

- If not otherwise agreed, the tax on the increase of the value of urban land (municipal capital gains tax) (“plusvalía municipal”).

The buyer, in turn, must take into account the payment of:

- The purchase price of the dwelling.

- The expenses of the public instrument of the mortgage loan, if any.

- The VAT (10% of the cost of the dwelling) if it deals with new construction or the Property Transfer Tax (ITP) if it is a second-hand dwelling.

- The notary fees in the presence of whom the public deed of purchase and sale is granted.

- The registering expenses in the Property Registry and the expenses of this procedure, if it is done by a third party.

- If a mortgage is applied for, the opening expenses of the loan.

- The expenses of registration and/or change of holder of the services of water, electricity, gas, etc.

- The insurance, as least, of the risks that are derived from fortuitous causes, force majeure and damage to third parties.

It is the right of the buyer to choose the notary who executes the deed of sale and purchase. It should be emphasized that the buyer does not become the legal owner of the dwelling until the signing of the deed, in the presence of the notary, and takes effective possession of the keys.

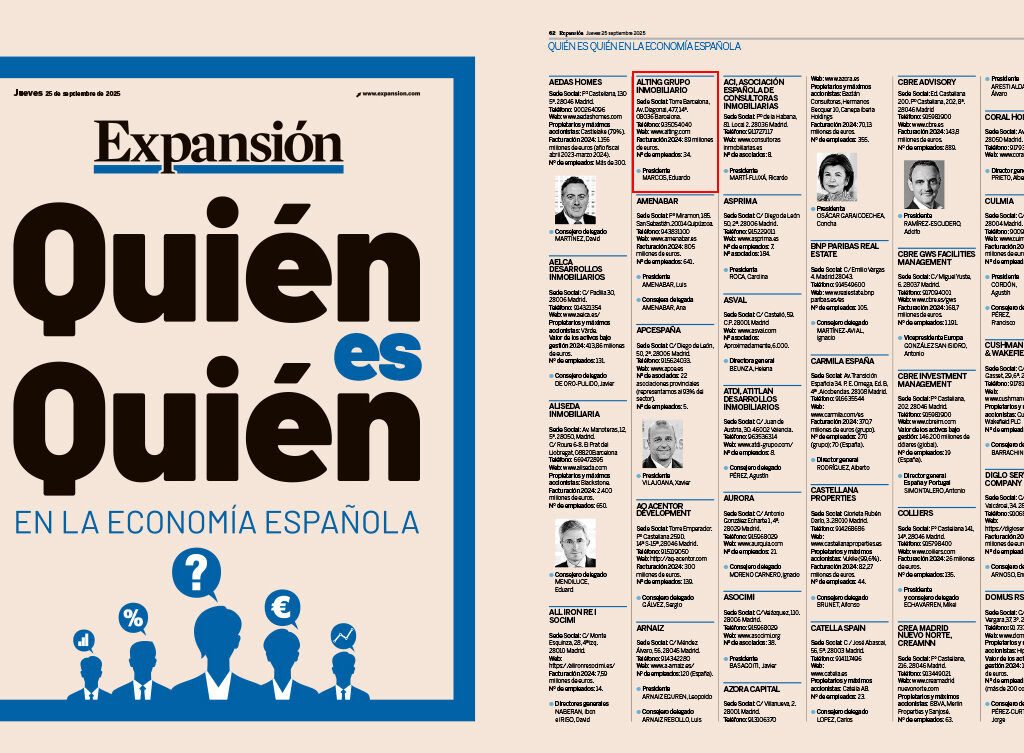

At Alting Real Estate Consulting we are specialists in the search for and marketing of luxury apartments and houses for sale and rent in the Zona Alta and in the center of Barcelona. Whether you want to sell a property or if you are seeking a new home, our advisers will work jointly to find the best solution for your needs. They will accompany you during the entire process of the operation and will offer you a global range of real estate services to get the best result in the least time possible.