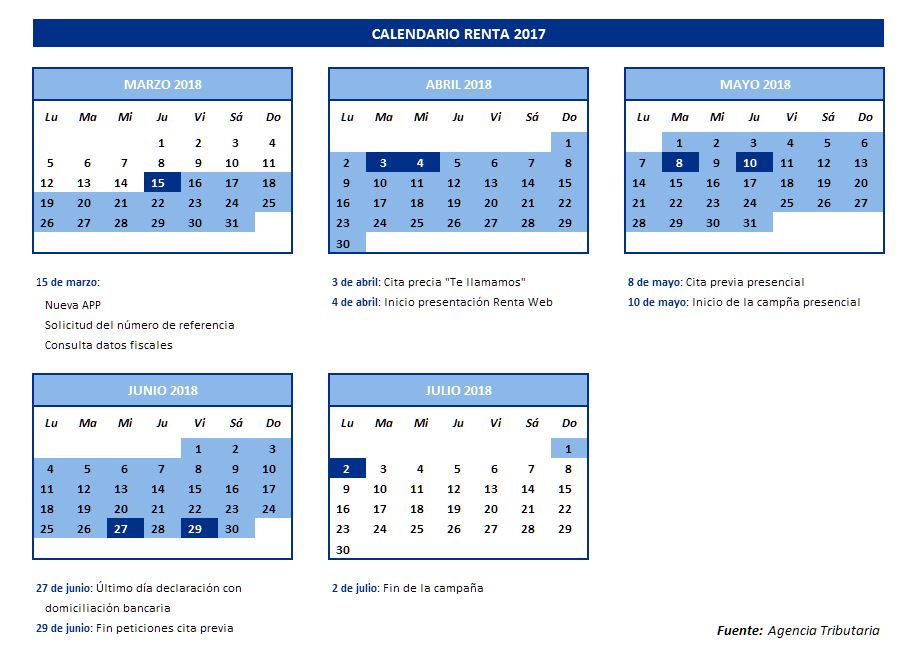

The 2017 Tax Return Campaign officially begins on the 4th of April with the launch of online tax returns via the “Renta Web”. However, the in-person campaign will not begin until the 7th of May. In either one, taxpayers have until the 2nd of July to submit their tax returns.

This year, the Tax Agency has reported that it is expecting to register more than 19 million tax returns, bring in more than 153 million euros and return around 9.468 billion euros.

There are two important new developments this year, namely the Tax Agency’s mobile app and the new “We’ll phone you” plan. The new app allows taxpayers to check their tax information and submit a draft return provided no changes are needed (although they recommend doing it via a PC). With the “We’ll phone you” option, users can phone in to request an appointment, and a Tax Agency employee will phone them on the agreed upon day and time to fill out the tax return by telephone.

Regarding the home income tax return campaign, in this last tax year there are no significant changes compared to 2016 for either real estate that is owned or for people who rent their homes.

What do you need to know if you own real estate?

In all the autonomous communities (ACs) under the common system, homes and vacant commercial properties generate a tax on real estate returns, an estimated payment that is calculated as a percentage of the cadastral value.

Deductions from the purchase of a home vanished with the 2012 tax reform. However, all taxpayers who bought their home before the 1st of January 2013 have the right to an income tax deduction. This deduction is solely applied if this is the owner’s habitual residence, but not for second homes.

If the home was bought with outside financing, such as a mortgage, the mortgage holders can deduct 15% of the total amount paid (capital, interest, expenses, and taxes) throughout the previous year up to a limit of €9,040. The Treasury will refund a maximum of €1,356 per person, and twice as much of the owners file their income tax return separately.

Anyone who undertook refurbishments of or adaptations of their habitual residence for reasons of disability before the 1st of January 2013 and whose refurbishments were completed before 2017 also have the right to this deduction.

Finally, capital gains from the sale of property must be paid in the income tax return. However, these gains are exempt when:

- The earnings from the purchase are reinvested in purchasing a new habitual residence.

- The sellers are over the age of 65.

However, Navarra and the Basque Country have their own tax systems and continue to maintain deductions for home purchases.

The specific case of the ground clauses

Taxpayers who received money from ground clauses last year deserve special mention, since they have to remember this extraordinary income when submitting their 2017 tax returns.

Likewise, this income is considered an indemnification which should not be taxed as income, nor should the interest on arrears.

However, taxpayers who at some point applied the deduction for investment in a habitual residence for these amounts which are now reimbursed will lose the right to deduct them.

Furthermore, they must regularise their deductible expenses from the 4 tax periods outside the time period, 2013 to 2016.

So what about rental homes?

If we turn our attention to rental homes, we have to distinguish between tax obligations or benefits depending on whether the taxpayer is the tenant or the owner.

- Living in a rental property

The state deduction for rent of a habitual residence has also vanished, but the majority of autonomous communities have retained some of the tax deductions for rental assistance for youths, disabled persons or the elderly with a certain income following different criteria in each region. This year, only Murcia and La Rioja do not allow rent to be deducted under any circumstances. - Renting a property

When you rent a property, real estate returns are generated which have to be taken into account in your tax return. In order for the property owner to be able to apply a 60% reduction, the rented property must be the tenant’s habitual residence.

However, vacation rentals are not deductible since they are temporary rentals instead of the tenant’s habitual residence. In this case, the expenses on utilities (electricity, water, gas, etc.) can be deducted along with the financial expenses associated with the purchase of the home, along with conservation or rehabilitation expenses and insurance premiums.

The Treasury has already begun to process the refunds of the first tax returns with overpayments filed.

For more information, check the Tax Agency’s 2017 Practical Tax Guide.